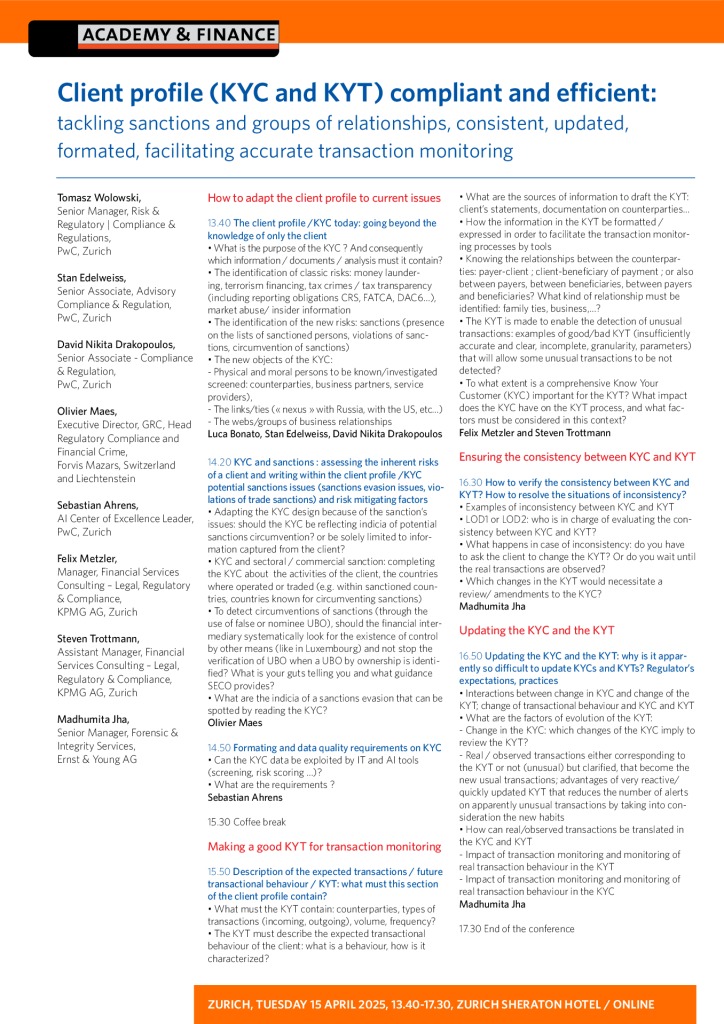

How to adapt the client profile to current issues

The client profile /KYC today: going beyond the knowledge of only the client

- What is the purpose of the KYC ? And consequently which information / documents / analysis must it contain?

- The identification of classic risks: money laundering, terrorism financing, tax crimes / tax transparency (including reporting obligations CRS, FATCA, DAC6…), market abuse/ insider information

- The identification of the new risks: sanctions (presence on the lists of sanctioned persons, violations of sanctions, circumvention of sanctions)

- The new objects of the KYC:

- Physical and moral persons to be known/investigated screened: counterparties, business partners, service providers),

- The links/ties (« nexus » with Russia, with the US, etc…)

- The webs/groups of business relationships

KYC and sanctions : assessing the inherent risks of a client and writing within the client profile /KYC potential sanctions issues (sanctions evasion issues, violations of trade sanctions) and risk mitigating factors

- Adapting the KYC design because of the sanction’s issues: should the KYC be reflecting indicia of potential sanctions circumvention? or be solely limited to information captured from the client?

- KYC and sectoral / commercial sanction: completing the KYC about the activities of the client, the countries where operated or traded (e.g. within sanctioned countries, countries known for circumventing sanctions)

- To detect circumventions of sanctions (through the use of false or nominee UBO), should the financial intermediary systematically look for the existence of control by other means (like in Luxembourg) and not stop the verification of UBO when a UBO by ownership is identified? What is your guts telling you and what guidance SECO provides?

- What are the indicia of a sanctions evasion that can be spotted by reading the KYC?

Formating and data quality requirements on KYC

- Can the KYC data be exploited by IT and AI tools (screening, risk scoring …)?

- What are the requirements ?

Making a good KYT for transaction monitoring

Description of the expected transactions / future transactional behaviour / KYT: what must this section of the client profile contain?

- What must the KYT contain: counterparties, types of transactions (incoming, outgoing), volume, frequency?

- The KYT must describe the expected transactional behaviour of the client: what is a behaviour, how is it characterized?

- What are the sources of information to draft the KYT: client’s statements, documentation on counterparties…

- How the information in the KYT be formatted / expressed in order to facilitate the transaction monitoring processes by tools

- Knowing the relationships between the counterparties: payer-client ; client-beneficiary of payment ; or also between payers, between beneficiaries, between payers and beneficiaries? What kind of relationship must be identified: family ties, business,…?

- The KYT is made to enable the detection of unusual transactions: examples of good/bad KYT (insufficiently accurate and clear, incomplete, granularity, parameters) that will allow some unusual transactions to be not detected?

- To what extent is a comprehensive Know Your Customer (KYC) important for the KYT? What impact does the KYC have on the KYT process, and what factors must be considered in this context?

Ensuring the consistency between KYC and KYT

How to verify the consistency between KYC and KYT? How to resolve the situations of inconsistency?

- Examples of inconsistency between KYC and KYT

- LOD1 or LOD2: who is in charge of evaluating the consistency between KYC and KYT?

- What happens in case of inconsistency: do you have to ask the client to change the KYT? Or do you wait until the real transactions are observed?

- Which changes in the KYT would necessitate a review/ amendments to the KYC?

Updating the KYC and the KYT

Updating the KYC and the KYT: why is it apparently so difficult to update KYCs and KYTs? Regulator’s expectations, practices

- Interactions between change in KYC and change of the KYT; change of transactional behaviour and KYC and KYT

- What are the factors of evolution of the KYT:

- Change in the KYC: which changes of the KYC imply to review the KYT?

- Real / observed transactions either corresponding to the KYT or not (unusual) but clarified, that become the new usual transactions; advantages of very reactive/ quickly updated KYT that reduces the number of alerts on apparently unusual transactions by taking into consideration the new habits

- How can real/observed transactions be translated in the KYC and KYT

- Impact of transaction monitoring and monitoring of real transaction behaviour in the KYT

- Impact of transaction monitoring and monitoring of real transaction behaviour in the KYC

SPEAKERS

Tomasz Wolowski, Senior Manager, Risk & Regulatory | Compliance & Regulations, PwC, Zurich

Stan Edelweiss, Senior Associate, Advisory Compliance & Regulation, PwC, Zurich

David Nikita Drakopoulos, Senior Associate – Compliance & Regulation, PwC, Zurich

Olivier Maes, Executive Director, GRC, Head Regulatory Compliance and Financial Crime, Forvis Mazars, Switzerland and Liechtenstein

Sebastian Ahrens, AI Center of Excellence Leader, PwC, Zurich

Felix Metzler, Manager, Financial Services Consulting – Legal, Regulatory & Compliance, KPMG AG, Zurich

Steven Trottmann, Assistant Manager, Financial Services Consulting – Legal, Regulatory & Compliance, KPMG AG, Zurich

Madhumita Jha, Senior Manager, Forensic & Integrity Services, Ernst & Young AG

Client profile (KYC and KYT) compliant and efficient : tackling sanctions and groups of relationships, consistent, updated, formated, facilitating accurate transaction monitoring

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch